MTM accounting helps provide a real-time valuation of assets and liabilities, offering insight into a company’s finances that historical cost accounting may not reveal. As such, it plays a crucial role for investors, management teams, and derivative traders. Although it can sometimes exacerbate volatility in the markets, MTM accounting is generally seen as a necessary and positive component of our financial markets and reporting practices. The debate occurs because this accounting rule requires companies to adjust the value of marketable securities (such as the MBS) to their market value. The intent of the standard is to help investors understand the value of these assets at a specific time, rather than just their historical purchase price. As initially interpreted by companies and their auditors, the typically lesser sale value was used as the market value rather than the cash flow value.

Now in the day of trade after the purchase was mad the price of the share fell to $4 per share. Thus the mark to the market value of his investment now stands at $4000 even though the book value is $5000. Thereby on that day on a more realistic approach, his investment stands at $4000 based on mark to market methodology. The gains and losses that occur due to changes in the market value of assets that are classified as available for trading are reported on the income statement as unrealized losses or gains.

How Does One Mark Assets to Market?

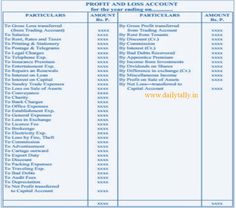

Then, using an estimate of the percentage of customers expected to take the discount, the company would record a debit to sales discount, a contra revenue account, and a credit to “allowance for sales discount,” a contra asset account. Mark to market is a way of valuing securities at the current market price. The gain or loss of market value for these available for sale securities is reported as part of the account other comprehensive income located in the balance sheet’s equity section. When individuals use mark to market accounting for their personal accounting, the market value is used in the same way replacement cost is used for an asset. Building a cash flow statement from scratch using a company income statement and balance sheet is one of the most fundamental finance exercises commonly used to test interns and full-time professionals at elite level finance firms.

Once or twice a year you should meet with your financial advisor to rebalance your holdings. An adviser can help you determine the correct allocation based on your personal financial goals. On the other hand, the same account will be added to the account of the trader on the other end of the transaction.

The market value is determined based on what a company would get for the asset if it was sold at that point in time. Overall, mark to market is used to get a more accurate idea of what a company’s assets or liabilities are really worth today. It is an important concept that is used widely throughout finance, investing, and accounting. Mark to market accounting forced banks to write down the values of their subprime securities. Now banks needed to lend less to make sure their liabilities weren’t greater than their assets.

In the securities market, fair value accounting is used to represent the current market value of the security rather than its book value. It is done by recording the prices and trades in an account or portfolio. While mark to market accounting may give a better snapshot of what the assets on a company’s balance sheet would be worth if it had to liquidate them today, that can have some negative consequences. FAS 157 requires that in valuing a liability, an entity should consider the nonperformance risk.

Even is the security trading mark to market involves recording the price of a security or a portfolio to depict the market value of the security instead of the book value. In personal accounting to we use the mark to a market where the market value of an asset is equivalent to the cost of replacement. Thus we see in so many fields we use this concept ranging from securities such as futures, stocks, and mutual funds which help us show the current market value of these investments. Mark to market (MTM) is an accounting method whereby assets and liabilities are recorded at their current market value. In other words, if a company had to liquidate its assets and pay off all its debts today, mark to market accounting would give you an accurate picture of how much it would be worth. It’s also used in valuing accounts holding financial instruments like futures and mutual funds.

Advantages & Disadvantages of Mark-to-Market Accounting

It is a very effective methodology to estimate the real value of assets thought it has both pros and cons to it. It is a forward-looking approach and thus is preferred widely by investors especially in the field of futures trading. It not only helps investors to estimate how much money they have lost or gained during a day but also prevents investors from counterparty risk. A very simple example to explain the concept of mark to market can be a scenario of stock market investing. Suppose a trader has purchased 1000 shares of a company at $5 per share which makes his investment as $5000.

The point of our paper is to argue that using accounting values based on market prices can significantly exacerbate the problem of contagion in such circumstances. The notion that market prices cannot be trusted to value assets in times of crisis has a long history. In his influential book, Lombard Street, on how central banks should respond to crises, Bagehot (1873) argued that collateral should be valued weighting panic and pre-panic prices. Our conclusion is similar in that in times of crisis market prices are not accurate measures of value.

At the end of every day, the broker will mark to market the value of the futures contract. If the total value of the contract increased, it’ll add cash to your account. If the value of the futures contract declines too much, you may fall below the margin requirements set by your broker, which will force you to liquidate your position or add cash to your account.

FAS 157 / Accounting Standards Codification Topic 820

In the latter method, however, the asset’s value is based on the amount that it may be exchanged for in the prevailing market conditions. However, the mark to market method may not always present the most accurate figure of the true value of an asset, especially during periods when the market is characterized by high volatility. You’re simply entering into an agreement to buy or sell a commodity at some point in the future. In order to ensure you can settle that contract, your broker will require you to hold a certain amount of cash, typically a relatively small percentage of the contract’s value. Mark to market accounting gives shareholders and potential business partners a better understanding of a company’s current balance sheet. For example, let’s say a company decides to invest its cash in long-term Treasury bonds.

If FAS 157 simply required that fair value be recorded as an exit price, then nonperformance risk would be extinguished upon exit. However, FAS 157 defines fair value as the price at which you would transfer a liability. In other words, the nonperformance that must be valued should incorporate the correct discount rate for an ongoing contract. An example would be to apply higher discount rate to the future cash flows to account for the credit risk above the stated interest rate.

Marking-to-market a derivatives position

Such reports can spook investors and depositors, potentially creating the conditions for a bank run. Similar events occurred in the 2008 financial crisis, where investors were spooked by unrealized losses on mortgage-backed securities and other assets. Let’s look at a practical example of MTM in the trading of futures contracts. This means the gain or loss on the contract is calculated and recorded at the end of each trading day. When compared to historical cost accounting, mark to market can present a more accurate representation of the value of the assets held by a company or institution. It is because, under the first method, the value of the assets must be maintained at the original purchase cost.

- Mark to market (MTM) is a method of measuring the fair value of accounts that can fluctuate over time, such as assets and liabilities.

- The potential problems that might have arisen had Long Term Capital Management (LTCM) been allowed to go bankrupt illustrate the issue.

- The difference between mark to market and historical accounting cost is that mark to market is more of a forward-looking approach whereas historical accounting maintains the cost of the asset at its base price or original price.

- The level of liquidity in such markets is endogenously determined and there is liquidity pricing.

- But using mark to market accounting can give investors a full picture of how market conditions have affected a company’s investments.

- It must be based on an estimate of the number of customers likely to accept a discount.

If the market price has changed between the ending period

(12/31/prior year) and the opening market price of the following year (1/1/current year), then there is an accrual variance that must be taken into account. Mark to market is an accounting standard governed by the Financial Accounting Standards Board (FASB), which establishes the accounting and financial reporting guidelines for corporations and nonprofit organizations in the United States. FASB Statement of Interest “SFAS 157–Fair Value Measurements” provides a definition of “fair value” and how to measure it in accordance with generally accepted accounting principles (GAAP). Assets must then be valued for accounting purposes at that fair value and updated on a regular basis. A company that offers discounts to its customers in order to collect quickly on its accounts receivables (AR) will have to mark its AR to a lower value through the use of a contra asset account. The previous loss must settle first from the current gain to reflect the true and correct position in the accounts.

FAS 115

We focus on the case where the banks are always solvent despite the risk of their loans. The insurance companies insure a second group of firms against the possibility of their machines being damaged the following period. They collect premiums and invest them in the short asset to fund the costs of repairing the firms’ machines.

The market value is arrived at by determining what a business would obtain for selling the asset at that point. By using the MTM method, Berkshire Hathaway provides a transparent report to their investors, reflecting that their stock portfolio significantly declined in value during the year. As illustrated by the previous years in the chart, the principle also works in reverse, with increases in the portfolio’s value resulting in reported profitability. As you can see, the MTM method is fulfilling its purpose of telling investors what the asset is actually worth as of the reporting date. It’s important to remember that there is an important difference between ‘realized’ and ‘unrealized’ gains or losses. Realized gains or losses occur when an asset is actually sold, whereas unrealized gains or losses represent the potential profit or loss, even if the asset is not actually sold.

Mark-to-market losses occur when financial instruments held are valued at the current market value, which is lower than the price paid to acquire them. The daily mark to market settlements will continue until the expiration date of the futures contract or until the farmer closes out his position by going long on a contract with the same maturity. In this situation, the company would record a debit to accounts receivable and a credit to sales revenue for the full sales price.

Impact of DDEP impairment losses on banking sector and role of … – Myjoyonline

Impact of DDEP impairment losses on banking sector and role of ….

Posted: Mon, 21 Aug 2023 19:24:33 GMT [source]

In contrast, if values based on historic cost are used, banks can continue and meet all their future liabilities. We discuss the implications for the debate on mark-to-market versus historic cost accounting. In contrast, when assets are priced according to market values, low prices can cause a problem of contagion from the insurance sector to the banking sector. Even if banks would be solvent if they were allowed to continue, the current market value of their assets can be lower than the value of their liabilities. Banks are then declared insolvent by regulators and forced to sell their long term assets.

If accounting values are based on historic costs, this problem does not compromise the solvency of banks as it does not affect the accounting value of their assets. In contrast, when accounting values are based on market prices, the volatility of asset prices directly affects the value of banks’ assets. This can lead to distortions in banks’ portfolio and contract choices and contagion. Banks can become insolvent even though they would be fully able to cover their commitments if they were allowed to continue until the assets mature.